Chip shortage and impact on the stock market

What investment opportunities does the lack of chips bring?

Several industries have been hit by the crisis over the acute shortage of semiconductors, often referred to as chips. Talk about it began at the turn of 2020 and 2021, but at the time, experts said that in the summer of 2021, everything should be fine. Except that it was not and on the contrary, the situation worsened. Let us look at the most problematic sector – the automotive industry – and the investment opportunities that this crisis brings.

Today, virtually all technology industries rely on such semiconductors. There is talk mainly of cars, but the problem also affects smartphones, washing machines and basically all electronics. It is not for nothing that semiconductors are said to be the brains of modern electronics. When they are missing, electronics cannot be manufactured. The demand for it is currently very high.

Apple has already warned that a shortage of semiconductors may soon affect iPhone sales, but the automotive industry is worse off. He already had to act. Brands such as Toyota, Ford and Volvo had to slow down or temporarily stop production. And try to go to the store of a well-known Czech brand, when you could take a vehicle unloaded according to your ideas from their showroom. You should not be surprised. Carmakers are no longer able to meet demand and are losing money.

Why has the crisis mainly affected cars?

To fully understand the issue, we must move to the beginning of the pandemic, ie to March 2020. In view of the impending global crisis and the global recession, the carmakers have followed past experience and canceled orders for a number of semiconductors. Their assumptions and visions spoke of a significant decline in interest in cars.

However, the world shook rapidly from the first wave and life returned to almost normal. In addition, many people have saved money during quarantine periods and interest in new cars has risen sharply. Automotive leaders responded to the situation and contacted semiconductor manufacturers, but they failed: in the meantime, they devoted capacity to companies dedicated to telephones, computers or video games. As many people worked or learned from home, there was excessive interest in these things.

Other factors that contributed to the shortage of semiconductors should also be mentioned. One of the factors is the rise of COVID in Malaysia, but also, for example, the extremely cold period in Texas or the fire in a Japanese semiconductor factory. These were all further blows to the waist for the carmakers.

How many chips does one car need?

Modern cars need a number of chips and their number increases with the number of electronic systems in the car. The older Ford Focus, for example, uses about 300 chips, but new electric cars of the same brand use up to 3,000. In addition, there is a growing demand worldwide for chips that are extremely chip-intensive.

Interesting data was provided by Intel. It announces that in 2030, semiconductors will take care of at least 20% of the production costs of new cars. In 2019 it was still only 4% and in 2025 it should be around 12%. It is therefore clear that semiconductor production will need to be increased enormously and companies operating in this field can benefit. A hint of an investment opportunity?

Until that happens, automakers will pay extra for it. In 2021 alone, according to current estimates, they will lose about 210 billion US dollars. This is one of the reasons why car manufacturers’ stock prices have started to fall since around June. However, very high demand and ever-smaller supply are currently ensuring that the prices of new cars are rising. As a result, they are more profitable, and as the market assumes that the crisis may not last very long, car stock prices are relatively stable and even rising slightly.

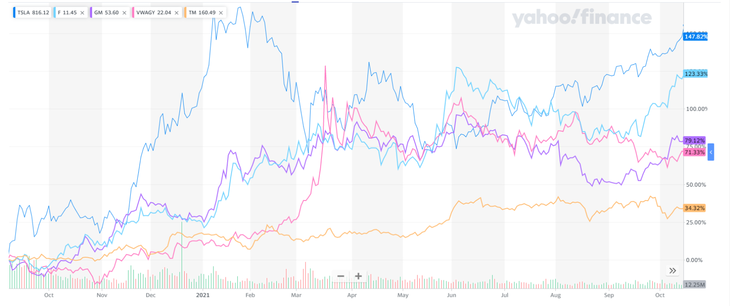

To illustrate, we enclose a chart of the development of shares of Tesla, Ford, General Motors, Volkswagen and Toyota over the last year:

How long will the crisis last?

Back in April, Cisco CEO Chuck Robbins told the BBC that the worst of the crisis would last six months and then semiconductor suppliers would be able to build more capacity. According to him, the situation should have improved significantly during the period of twelve to eighteen months, ie sometime in the middle of next year, or in the third quarter.

When the leaders of the individual cars at the Munich Motor Show were asked the same question in September 2021, their opinions were different. As CEO of Škoda, Thomas Schäfer indicated that the shortage of semiconductors would continue in 2022. Ola Källenius of Daimler said that the situation should improve in the last quarter of 2021, but fears that we will continue to feel the effects of the crisis in 2023. .

Well, the most careful was Ford’s head of Europe for Europe, Gunnar Herrmann, who indicated to CNBC that we could still feel the lack of chips in 2024. He did not dare to predict the end of the crisis at all.

The basic question we need to ask ourselves at the moment is this: Will or will the ongoing crisis have a more significant impact on the development of car giant stock prices? The answer suggests further considerations.

How are car manufacturers reacting to the crisis?

The approach of individual cars is very similar and to some extent logical. In the short term, they try to limit the production of older models of vehicles, or those vehicles that take care of the least profit. Those who bring the most profit receive the latest available chips. That’s why carmakers are doing quite well so far.

Some carmakers continue to produce vehicles, but without chips they park them in large parking lots and wait for the necessary semiconductors to be delivered. Well, chip saving is also a common solution. This can be done by delivering cars without some features; GM, for example, has stopped supplying equipment accessories such as an automatic start-stop system or a fuel management module.

Who benefits most from the crisis?

Each coin has two sides, and whenever someone gets into trouble, there are opportunities. Someone is losing or stagnating, someone is profiting. In this case, semiconductor manufacturers and, of course, their suppliers began to benefit. And given the acute shortage of semiconductors and how many the world will need in the coming years, this segment will grow significantly.

Companies that are best prepared for this situation include ASML, Qualcomm, Intel, Micron, Samsung, Texas Instruments, Taiwan Semiconductor Manufacturing Company (TSMC), but many others. Highlights are Intel, Samsung and TSMC, as these companies are currently expanding their production capacity. Well, ASML, which is one of TSMC’s suppliers, is in a good position. This brand, in turn, is a supplier to Qualcomm and Apple.

Therefore, semiconductor manufacturing will guarantee these companies a profit and they should have a bright future. So, would you invest in them? Or will it be completely different in the end?

Invest with IAD Investments

The portfolio managers of the management company IAD Investments monitor and monitor the situation on world markets on a daily basis. Thanks to this, and especially thanks to their many years of experience, they know how to identify the right moments for buying or selling shares of individual companies and to include or exclude them from the portfolio of individual funds. Join the satisfied clients of IAD Investments and invest with us.

You can find more information at www.iad.sk, or we will be happy to provide them to you on the phone number 0800 601 601.