How to defend against record inflation?

The European Union is coping with a record rate of inflation. In December 2021, it exceeded the year-on-year level of 5% and the situation is becoming serious. We have become accustomed to such high inflation in recent years, and the resulting panic is beginning to put pressure on the European Central Bank (ECB), which is expected to take action.

Current information suggests that increased inflation could only be a short-term phenomenon. It was partly caused by pandemic developments, which brought certain specifics.

Why did inflation rise?

During 2021, several restrictions were lifted and the economies of individual countries began to open up. Ordinary people who sat at home for a long time started going out again and traveling. In addition, many managed to save during the lockdown period and were prepared to spend more money. To a certain extent, they “caught up” with the consumption they had missed in previous periods and took care to put upward pressure on prices.

There is another thing to know about this phenomenon. Manufacturing companies have not been able to respond quickly enough to growing demand. Due to pandemic constraints, they had logistical problems (such as a lack of shipping containers) and were unable to meet high demand. It exceeded supply in many areas and prices logically rose.

Other factors causing inflation

Many people started working from home and needed to improve their electronic equipment, which automatically caused, for example, a shortage of semiconductors. In addition to electronics, they are also needed for the automotive industry, and prices in these areas had to go logically up.

Well, to all this must be added the global rise in oil, gas and electricity prices, which reached a year-on-year level of 26% in December in the European Union. Thus, there are quite a few high-inflation causes, but experts assume that they are only of a short-term nature.

How does the ECB’s chief economist see the situation?

Philip Lane, the chief economist of the ECB, commented on the situation at the beginning of January 2022. He seemed calm and patiently explained that this was only a temporary phenomenon.

“The period 2020 to 2022 is part of a pandemic cycle of inflation,” he explained in an interview with Irish radio RTE. “Inflation will fall this year, but it will continue to be higher than we would like it to be in the long run. In 2023 and 2024, it should fall slightly below the bank’s target. ”

“Yes, when we hear numbers like 5% after a long period of low inflation, it sounds a little weird. However, we think that inflationary pressures will weaken later this year, “Lane added.

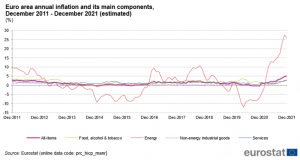

EU inflation chart:

The US is worried even more

The raised warning finger comes from the USA, which is currently even worse off than the European Union. The year-on-year inflation rate there reached 6.8%, which is the highest since 1982. The biggest problem was caused by the rise in oil prices, which in November was + 58.1% year-on-year. This is the highest number since 1980.

According to CNN, the increase in prices overseas was caused by similar factors as in Europe. In addition to rising energy prices, there is also chaos in the supply chain caused by logistical problems and higher transport costs. All of this was ultimately bounced off by customers, on whom the increased prices were passed on. Another strong factor is, for example, the increased cost of housing.

Expected development in Slovakia

The National Bank of Slovakia (NBS) also issued an opinion on the inflation situation, which convened a press conference just before Christmas. On the one hand, it announced a relatively strong GDP growth of 5.8% for 2022, but at the same time it also spoke of seven percent inflation.

The peak at the level of the mentioned approximately 7% should come in the first part of 2022 and subsequently inflation should fall to two percent, which we could reach at the end of 2023. According to the NBS, this development is mainly influenced by external factors.

How to fight inflation?

Inflation is, in layman’s terms, a phenomenon in which money loses its value. They devalue at home in a “pillow” and also devalue in current accounts, which have long been remunerating at almost zero. And how to fight inflation? The solution is called investing.

Experts from IAD Investments will value your money through investment funds. There are currently a total of 14 of them and you just have to choose the right one. In the category of dynamic funds for the period from 1.1.2021 to 31.12.2021 they achieved the following appreciation: Global Index 29.46% and KD RUSSIA 22.88%. However, the balanced Growth Opportunities Fund also succeeded, with an appreciation of 13.58% in the period from 1 January 2021 to 31 December 2021.

Do not hesitate to contact your financial intermediary to choose the right fund for you.